Beginners’ Guide to Stock Market Terminology

- Felix La Spina

- Jul 7, 2025

- 6 min read

Navigating the stock market can be challenging for beginners, especially when confronted with unfamiliar terminology and a sea of acronyms. This guide makes stock market language clear and accessible, providing straightforward definitions and practical examples of essential terms such as IPO, market capitalization, dividend, bull and bear market, and P/E ratio. Every term is explained in plain English to ensure you not only understand what it means, but also how it applies in real investing situations. Whether you are new to investing or looking to strengthen your foundational knowledge, this glossary will help you interpret financial news, understand company reports, and communicate more confidently about market trends. By building your knowledge of key vocabulary, you’ll be able to make informed decisions, spot opportunities, and avoid common mistakes. Use this resource as your go to reference whenever you encounter an unfamiliar word, and return to it as you progress in your investment journey. Over time, mastering these terms will become second nature and greatly increase your confidence and ability to succeed in the market. Whether you are investing for the first time, planning for your financial future, or simply want to feel more comfortable with market concepts, this guide is designed to support your growth every step of the way.

This clear, detailed glossary covers everything from IPOs and P/E ratios to Beta, EPS, and beyond, packed with real-world examples and tips for using these terms in your investing journey.

Why Learning Stock Market Terminology Matters

Understanding stock market terminology builds a strong foundation for every investor. Investing without this knowledge creates confusion, uncertainty, and frustration. Each core term provides insight into how the market functions and what influences investment outcomes. Clear understanding of stock market language leads to more confident decisions, accurate analysis of news, and stronger communication with financial professionals. Investors who master key vocabulary spot trends, evaluate opportunities, and recognize warning signs in the market. Knowing the meaning of terms like price-to-earnings ratio, market capitalization, or dividend yield enables detailed comparisons between companies and industries. This knowledge reduces the risk of making costly mistakes and missing valuable opportunities. Reading annual reports, market summaries, or analyst recommendations becomes easier and more useful. A well-developed investing vocabulary opens doors to deeper research, smarter questions, and better long-term results. Those who understand the language of stocks can participate in discussions, follow market changes, and keep up with new developments. Confidence grows as each term becomes familiar. Successful investing starts with clear understanding, and mastering stock market terminology sets every investor on the path to better financial outcomes and lifelong financial literacy.

Benefits of mastering stock market terms:

Make smarter investing decisions

Understand financial news and reports

Communicate confidently with advisors and peers

Avoid costly mistakes

Identify new opportunities quickly

Build long-term wealth with clarity and control

Essential Stock Market Terms (A–Z)

1. Stock

A stock (or share or equity) is a unit of ownership in a company. When you buy a stock, you own a piece of that business and may benefit from its success through rising share prices and dividends.

2. Index

An index is a group of stocks used to represent a portion of the market. Common examples include the S&P 500 (U.S. large caps), ASX 200 (Australia), and the Nasdaq (tech-heavy companies).

3. ETF (Exchange-Traded Fund)

An ETF is a fund that owns a basket of stocks or bonds and trades on the stock exchange like a single stock. ETFs offer easy diversification and low costs.

4. IPO (Initial Public Offering)

An IPO is when a private company first sells shares to the public. It’s how companies “go public” and get listed on a stock exchange.

Understanding the IPO process step by step:

The company prepares financials and files with regulators.

Investment banks set the offering price.

Shares are sold to institutional investors and then to retail investors.

The company lists on an exchange, and shares begin trading.

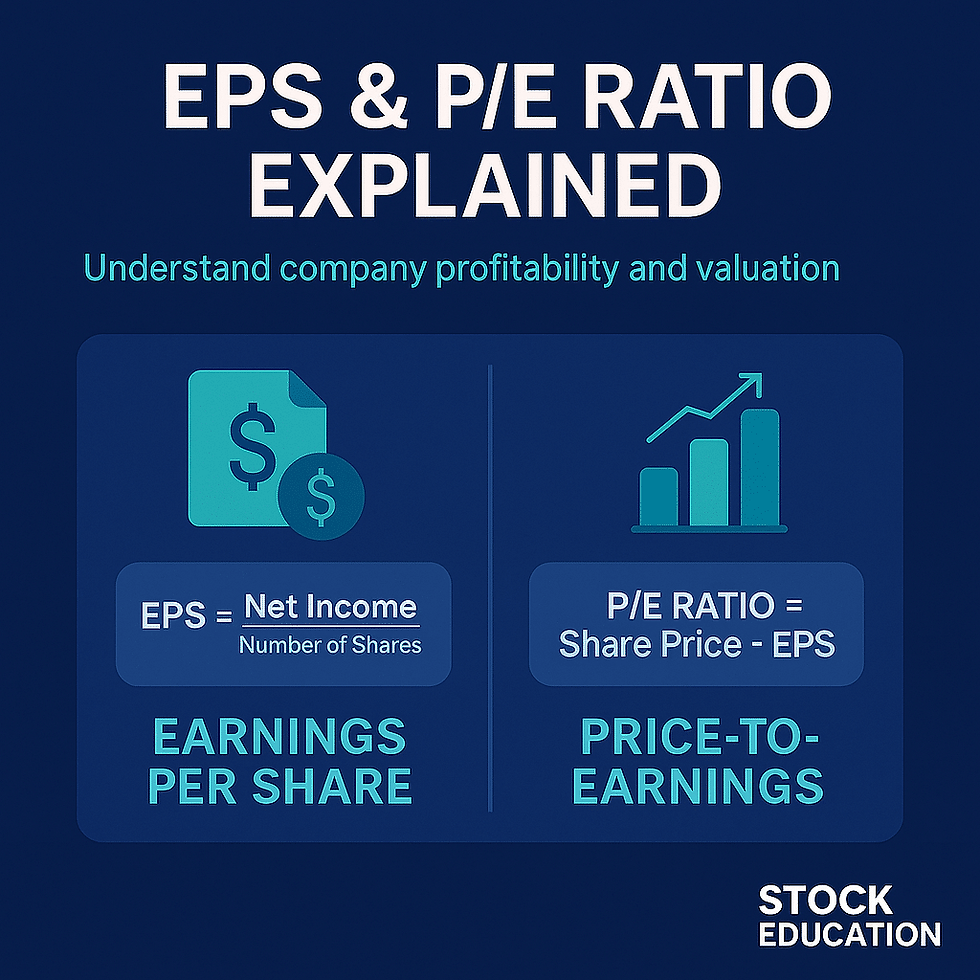

5. EPS (Earnings Per Share)

EPS shows how much profit a company earns for each share outstanding. Calculated as:

EPS = Net Income / Number of Shares

A rising EPS is often a good sign for investors.

6. P/E Ratio (Price-to-Earnings Ratio)

The P/E ratio compares a company’s share price to its EPS. It helps investors judge if a stock is “expensive” or “cheap” compared to its earnings.

High P/E: Investors expect fast future growth.

Low P/E: May be undervalued, but check why it’s low.

7. Beta

Beta measures a stock’s volatility compared to the market (which has a Beta of 1).

Beta > 1: More volatile than the market

Beta < 1: Less volatile

Beta = 1: Same as market

Beta helps assess risk when building your portfolio.

8. Market Capitalization (Market Cap)

Market cap is the total value of a company’s outstanding shares:

Market Cap = Share Price x Total Shares

Large-cap: $10 billion+

Mid-cap: $2–10 billion

Small-cap: <$2 billion

9. Dividend

A dividend is a cash payment to shareholders, usually from company profits. Not all stocks pay dividends.

10. Bull Market

A bull market is a period when stock prices are rising, often accompanied by optimism and strong economic growth.

11. Bear Market

A bear market is when stock prices fall 20% or more from recent highs, often driven by fear or economic downturns.

12. Blue-Chip Stock

A blue-chip stock belongs to a large, established, financially sound company with a history of reliable performance (e.g., Apple, Johnson & Johnson).

13. Volatility

Volatility refers to how much a stock’s price swings up and down. High volatility = bigger price moves, higher risk.

14. Yield

Yield usually refers to the dividend yield—how much cash a stock pays each year relative to its price.

Dividend Yield = Annual Dividend / Share Price

15. Portfolio

Your portfolio is your collection of investments (stocks, ETFs, bonds, cash, etc.).

16. Order Types

Market Order: Buys or sells at the current price.

Limit Order: Sets a specific price to buy or sell.

Stop-Loss Order: Sells automatically if the price drops to a set level.

17. Volume

Volume is the number of shares traded in a given period, used to gauge activity and liquidity.

18. Sector

A sector is a group of companies with similar business activities (e.g., technology, healthcare, energy).

19. Dividend Reinvestment Plan (DRIP)

A DRIP automatically uses dividends to buy more shares, compounding your returns.

20. Volatility Index (VIX)

The VIX is a measure of market volatility, sometimes called the “fear index.”

Stock Market Acronyms Decoded

ETF: Exchange-Traded Fund

IPO: Initial Public Offering

EPS: Earnings Per Share

P/E: Price-to-Earnings

REIT: Real Estate Investment Trust

NAV: Net Asset Value

DRIP: Dividend Reinvestment Plan

IPO: Initial Public Offering

IPO lock-up: The Period post-IPO when insiders can’t sell shares

Quick Reference Guide to Common Investing Terms

Every investor needs clear definitions for core stock market terminology. Ask/Bid refers to the price offered to buy or sell a stock. Ask means the lowest selling price. Bid means the highest buying price. Liquidity describes the ability to quickly buy or sell an asset without changing its value. Dividend Yield means the annual dividend payment shown as a percentage of share price. Diversification means investing in a variety of assets or sectors to reduce risk. Investors use these terms to read market reports, compare investments, and track performance. Market knowledge increases confidence. Understanding investing terms supports smarter trades and better portfolio choices. This guide provides a direct foundation for any stock market beginner seeking accurate financial vocabulary.

Tips for Learning Stock Lingo

Review trusted glossaries for stock market terms. Read definitions for each new investing word encountered in research or news. Choose reputable education sites such as StockEducation.com for clear explanations and updated examples. Watch for stock terms in financial headlines and company updates. Complete interactive quizzes on stock lingo. Write flashcards for quick review of definitions. Join online forums with investors and read conversations using financial terms. Repeat definitions aloud to strengthen memory. Use investing vocabulary in daily conversations. Strong language skills support better investment analysis, clear communication, and informed financial decisions.

Don’t be afraid to ask: No question is too basic when learning to invest.

Why Mastering Market Terminology Leads to Better Decisions

Mastering stock market terminology is essential for anyone who wants to become a confident and successful investor. Understanding investing vocabulary is not just for finance professionals or Wall Street insiders; it’s the key to making informed investment decisions, protecting your money, and spotting opportunities in the market. By learning core stock market terms, you’ll be able to read financial news, understand stock analysis reports, and communicate more effectively with brokers or other investors. This knowledge helps you avoid common investing mistakes, identify scams, and take advantage of new investment opportunities as they arise. Even if you’re a beginner or casual investor, building your financial literacy gives you the tools to evaluate stocks, ETFs, and mutual funds with confidence. When you know what terms like “dividend yield,” “market capitalization,” and “price-to-earnings ratio” really mean, you can compare companies, analyse trends, and make decisions based on facts rather than emotions. Stock market terminology also empowers you to ask better questions and stay calm during market volatility. Ultimately, understanding investing vocabulary isn’t just about learning new words—it’s about building the foundation for long-term wealth and smart financial choices. Bookmark this guide to stock market terms and return whenever you need a refresher. Start mastering the language of investing today and take control of your financial future.

Conclusion: Build Your Investing Vocabulary, Build Your Wealth

The stock market is full of complex terms, but once you master the basics, you unlock the power to invest confidently and successfully. Use this guide as your quick-reference glossary and return to it whenever you need a refresher.

Ready to learn more? For deeper lessons, downloadable glossaries, and practical investing tools, visit StockEducation.com and start your investing journey today!

Comments