Sell in May and Go Away: Examining This Seasonal Strategy

- Felix La Spina

- Jul 11, 2025

- 6 min read

Introduction: What Does “Sell in May and Go Away” Mean?

Few stock market sayings are as well-known, or as hotly debated, as “Sell in May and Go Away.” The phrase suggests investors should sell their stocks at the beginning of May, sit out the traditionally weaker summer months, and return to the market in November. But is this just financial folklore, or does it have a real, evidence-based track record?

This article breaks down the origins, historical data, pros and cons, and real-world results of the “Sell in May” strategy. You’ll learn what the numbers say, why the pattern exists, how modern investors might approach it, and what works if your goal is long-term wealth.

1. The Origin and Logic Behind “Sell in May and Go Away”

The phrase traces its roots to old English market wisdom: “Sell in May and go away, and come back on St. Leger’s Day.”This referenced a famous September horse race, essentially, a nod to the idea that the “smart money” would leave London for summer holidays, returning in autumn, and leaving markets listless and underperforming in their absence.

Today, “Sell in May” is widely discussed in the U.S., Australia, and across global markets to describe the tendency for the May-October period to deliver weaker or more volatile returns than the November-April “winter” period.

Key Points:

The effect is rooted in historical patterns of market performance and investor behavior.

It has been observed for decades, but its strength and reliability have changed over time.

2. What Does the Data Say? A Deep Dive into Market History

a. U.S. Market Evidence

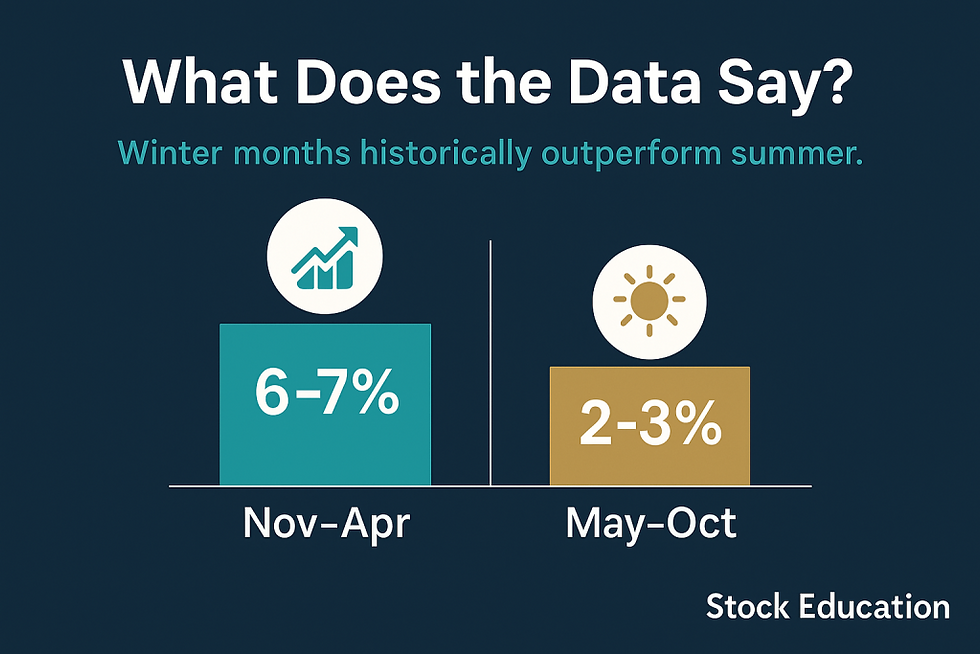

Multiple studies show that, on average, the S&P 500’s November-April returns outpace those from May-October.

From 1950–2023, the S&P 500 averaged about 6–7% gains during the winter period versus just 2–3% for the summer months.

Importantly, the pattern isn’t perfect: Some years see strong summer rallies, and others see winter slumps.

Example:

In the decade from 2010 to 2019, there were several years when summer delivered above-average returns, reminding investors that no seasonal strategy is foolproof.

b. International Patterns

The effect is strongest in the U.S. and U.K. markets, but also appears (in muted form) in some European and Asian countries.

The Australian market shows a less consistent “Sell in May” effect, likely due to different seasonality, holidays, and economic cycles.

c. Recent Trends

In the last decade, the effect has faded somewhat. Many years have seen strong summer gains.

The rise of global, round-the-clock trading and algorithmic investors has smoothed out some old calendar patterns.

Key takeaway: “Sell in May” is a historical average, not a guarantee.

3. Why Might Markets Underperform in Summer?

There are several explanations, some rooted in market structure, others in human psychology.

a. Lower Trading Volumes

Many professional investors and traders take summer holidays, leading to lower trading volumes and sometimes lower liquidity.

With fewer big players in the market, prices may drift sideways or react more dramatically to small bits of news.

b. Corporate News and Earnings Cycles

There are typically fewer earnings announcements and less economic data released in the summer, meaning less fuel for big market moves.

c. Seasonality in Investor Psychology

People are often distracted by holidays, school breaks, and travel, with less “fear of missing out” and fewer high-conviction trades.

Investors may be more conservative or risk-averse during summer months.

d. Historical Anomalies and Self-Fulfilling Prophecy

If enough investors believe in “Sell in May,” their actions can help create the very pattern they expect, at least some years.

“Crowded trades” can sometimes make patterns break down, as well.

4. Does “Sell in May” Actually Work? Pros and Cons

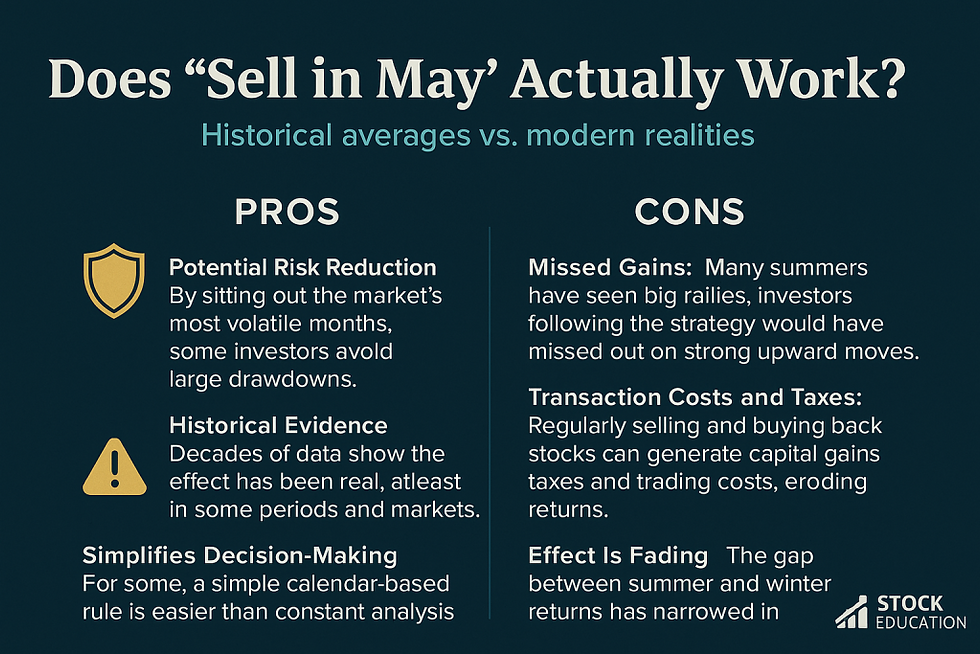

Pros

Potential Risk Reduction: By sitting out the market’s most volatile months, some investors avoid large drawdowns.

Historical Evidence: Decades of data show the effect has been real, at least in some periods and markets.

Simplifies Decision-Making: For some, a simple calendar-based rule is easier than constant analysis.

Cons

Missed Gains: Many summers have seen big rallies, investors following the strategy would have missed out on strong upward moves.

Transaction Costs and Taxes: Regularly selling and buying back stocks can generate capital gains taxes and trading costs, eroding returns.

Market Timing Risks: It’s impossible to predict which summers will be weak and which will be strong; missing even a few big “up” days can hurt long-term performance.

Effect Is Fading: The gap between summer and winter returns has narrowed in recent years, likely due to more efficient and global markets.

5. Real-World Performance: Sell in May Case Studies

a. The Lost Summer (2011)

During the 2011 U.S. debt ceiling crisis, stocks plunged over the summer. The “Sell in May” strategy would have protected investors from significant short-term losses.

b. Summer Surges (2013, 2020, 2021)

However, in 2013 and especially 2020 – 21 (post-pandemic rebound), the market saw strong summer rallies. Investors who stayed out missed massive gains.

c. Long-Term Impact of Market Timing

A Fidelity study showed that missing the ten best days in the market over 20 years could cut your total returns in half. Many of those days happened in “quiet” summer periods, proving how difficult it is to time perfectly.

d. The Australian Experience

The ASX has historically shown weaker seasonality than the S&P 500, but there are years when “Sell in May” would have helped, such as during financial shocks or local slowdowns. Yet, long-term returns tend to reward consistency more than timing.

6. Should Investors Use or Adapt the “Sell in May” Strategy Today?

a. Understand the Limits

The “Sell in May” effect is based on averages, not guarantees.

The strategy does not account for individual investment goals, risk tolerance, or the benefits of steady compounding.

b. Smarter Alternatives and Adaptations

i. Reduce Risk, Don’t Exit Completely

Instead of selling everything, consider trimming riskier holdings or rebalancing into defensive sectors (like utilities, healthcare, and consumer staples) before summer.

ii. Focus on Quality

Hold companies with strong balance sheets, reliable earnings, and resilient business models, which can weather any seasonal volatility.

iii. Dollar-Cost Averaging

Keep investing steadily every month, regardless of the season. This removes emotion, lowers average cost, and keeps you exposed to market rebounds.

iv. Tactical Portfolio Rebalancing

Use the “Sell in May” period as a reminder to review your asset allocation and make any needed adjustments.

v. Consider International Diversification

Global markets don’t always move together. Holding assets from multiple regions can help smooth out returns and reduce reliance on any one seasonal pattern.

7. Risks of Following “Sell in May and Go Away”

Missing Out on Gains: Some of the market’s biggest rallies have happened in “quiet” summer months.

Transaction Costs: Regular trading can add up through commissions, spreads, and taxes.

Emotional Decision-Making: Trying to time the market often leads to panic selling or FOMO buying.

Underperformance Over Time: Studies show that buy-and-hold investors who stay fully invested typically outperform those who try to time exits and entries, thanks to the power of compounding and not missing recovery rallies.

8. Frequently Asked Questions (FAQs)

Q: Is “Sell in May” backed by real research? A: Yes, as a historical pattern, but there’s no guarantee it will work every year. Seasonal trends are averages, not certainties.

Q: Does this apply to Australian stocks and other global markets? A: The effect is most pronounced in the U.K. and U.S. Some years, the Australian market follows the trend, but not always. Other regions may show different patterns.

Q: Should I move my superannuation or retirement savings because of this? A: No. Retirement portfolios should be managed for long-term growth, not short-term seasonal patterns.

Q: What about ETFs or index funds? A: The same logic applies; long-term investing in broad funds is usually the best approach for most people.

Q: Can professionals exploit “Sell in May” with advanced strategies? A: Some hedge funds and quant traders try to use seasonality as part of a much larger strategy, but for everyday investors, the effect is rarely big enough to justify complex moves.

9. Where to Learn More: Resources & Internal Links

Ready to take your stock market knowledge to the next level? See why more investors are choosingStockEducation.com, the leading platform for clear, actionable, and in-depth stock market education:

Expert-Crafted Learning Path: Access a step-by-step investing course built for every experience level, from complete beginner to advanced. No fluff, no confusion, just practical education that works.

Advanced Market Insights: Go beyond the basics with guides on seasonal strategies, market cycles, valuation, and risk management, all designed to help you make smarter decisions.

Learn at Your Pace, Apply with Confidence: Get lifetime access to lessons and resources that are always available, so you can build real investing skills on your schedule.

Built for Results: Every lesson is designed for clarity, depth, and immediate real-world application, so you can invest with confidence, not guesswork.

Stop wasting time on generic tips or surface-level advice. Start withStockEducation.com and experience the most credible, complete, and effective investing education available anywhere.

10. Final Thoughts: The Bottom Line on Seasonal Investing

“Sell in May and Go Away” is a catchy saying with a real historical footprint. But today’s markets are more global, information is faster, and investor behavior has evolved. While the pattern can sometimes offer clues, relying on it exclusively is risky.

What works best for most investors?

Consistent investing – regardless of season.

Diversification – across sectors, asset classes, and geographies.

Long-term thinking -viewing short-term patterns as interesting, but not as rules to live by.

If you experiment with seasonal strategies, do so with a small portion of your portfolio and clear expectations. For most people, building wealth is about staying invested, learning continuously, and letting compounding work through every market cycle.

Comments