What Is a Stock Split? And What Does It Mean for Investors?

- Felix La Spina

- Jul 29, 2025

- 2 min read

When a company like Apple or Tesla announces a stock split, headlines follow — and so do questions. Does it make the stock more valuable? Is it a buy signal? Should you care?

In this post, we’ll break down what stock splits are, why companies do them, and what they mean for investors like you.

What Is a Stock Split?

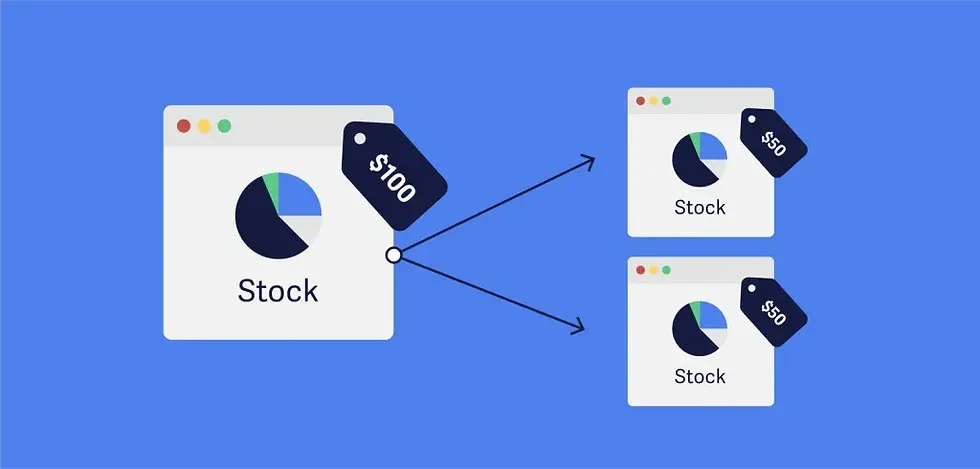

A stock split occurs when a company increases the number of its shares by issuing more to existing shareholders — while keeping the overall value of the company the same.

The most common type is a 2-for-1 split:

You get 2 shares for every 1 share you own

The share price is cut in half

Your total investment stays the same

For example:

Before the split: 1 share at $200 = $200

After a 2-for-1 split: 2 shares at $100 = still $200

Why Do Companies Split Their Stock?

Stock splits don’t change a company’s value — but they can improve accessibility and liquidity. Common reasons include:

✅ Lower share price: Makes the stock feel more affordable to everyday investors

✅ Boost liquidity: More shares in circulation = easier trading

✅ Positive signal: Often follows strong performance, which can build momentum

✅ Index eligibility: Lower-priced shares may make it easier to join certain indexes

In recent years, splits by Tesla, Apple, and Nvidia helped attract retail investors by making shares easier to buy.

Reverse Stock Splits: The Opposite Move

A reverse stock split reduces the number of shares while increasing the price per share. For example, a 1-for-10 reverse split turns 10 shares at $1 into 1 share at $10.

This is typically done by companies:

Trying to avoid delisting

Restructuring after major declines

Trying to appear more “respectable” with a higher share price

It’s often seen as a red flag — but not always.

Do Stock Splits Affect Value?

No. A stock split is like trading a $20 bill for two $10 bills — it doesn’t change the total value of what you own.

That said, some short-term effects can happen:

Increased investor interest (especially retail)

Temporary price bumps due to momentum or hype

More media and analyst coverage

But over time, the company’s fundamentals drive value — not the number of shares.

What Should Investors Do?

Here’s how to think about stock splits:

Don’t buy just because of a splitA split doesn’t change the company’s earnings, strategy, or competitive edge.

Look at the reason for the splitIs it following strong growth? That’s often a good sign. Is it a reverse split? Proceed with caution.

Use it as a chance to reassessIf a company you like splits, consider whether it still fits your long-term goals.

Final Thoughts

Stock splits may seem like big news, but they’re mostly cosmetic. They don’t change the underlying business — only the price and share count.

Still, they can be a sign of strength, and for many investors, they’re a good reminder to review your portfolio and long-term strategy.

👉 Want to see how a split might affect your investments? Use our investment calculator or read more in our Beginner’s Guide to Stock Terminology.

Comments